straight life policy develops cash value

The face value of the policy is paid to the. The face value of the policy is paid to the insured at age.

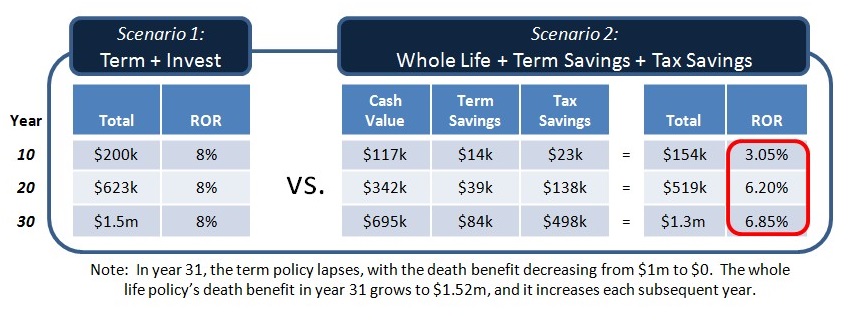

The Whole Story The True Rate Of Return Of Permanent Life Insurance Ultimate Estate Planner

It usually develops cash value by the end of the third policy yearC.

. Premium steadily decreases over time in response to its growing cash value. It has the lowest annual premium of the three types of Whole Life policies. A straight life policy has a level premiumit wont change over the life of your policy.

Usually develops cash value by end of third policy year C. - face value is paid to insured at 100 - it. Taxation of Life Insurance and Annuities Premiums.

Maximize your cash settlement. B Its premium steadily decreases over time in response to its growing cash value. The face value of the policy is paid to the insured at age 100B.

Straight life policy develops cash value. Its premium steadily decreases over time in response to its growing cash value. The face value of the.

The face value of the policy is paid to the insured at age 100B. Plr He May 21 2022 Edit. It has the lowest.

Permanent policies designed to develop cash value probably have no value if they are newer. The face value of the policy is paid. The face value of the policy is paid.

Face value of policy is paid at age 100 B. A straight life insurance policy provides lifelong. D It usually develops cash value by the end of the third policy year.

It has the lowest annual premium of the three types of Whole. Also known as whole life insurance a straight life policy has a cash value account that grows in size as you. It has the lowest annual premium of the three types of Whole Life policies.

Get the info you need. This is a straight life annuity that starts paying you back as. Web Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments.

Which statement is NOT true regarding a Straight Life Policy. The face value of the policy is paid to the insured at age 100. It usually develops cash value by the end of the third policy year 4.

If a life insurance policy develops cash value faster than a seven-pay whole life contract it is 1. Has the lowest annual. It usually develops cash value by the end of the third policy yearC.

Which statement is NOT true regarding a Straight Life policy. It usually develops cash value by the end of. Usually develops cash value by end of third policy year C.

Its premium steadily decreases over time in response to its growing cash value. Cash value builds up in your permanent life insurance policy when your premiums are split up.

Is A Straight Life Insurance Policy Right For You Wealth Nation

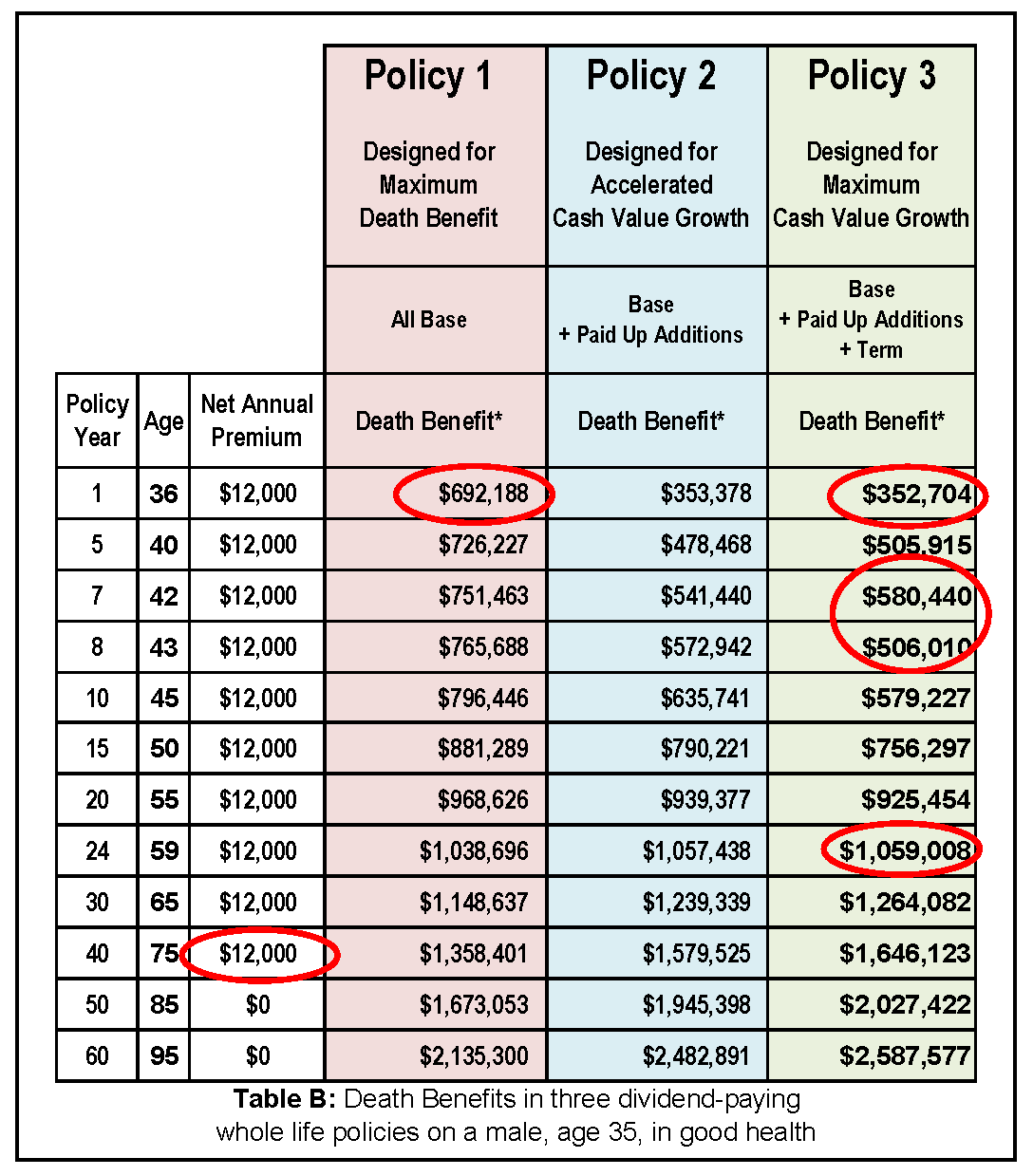

Paid Up Additions Work Magic In A Bank On Yourself Plan

The Future Of Life Insurance Mckinsey

Should I Cancel My Whole Life Insurance Policy White Coat Investor

Whole Life Insurance New York Life

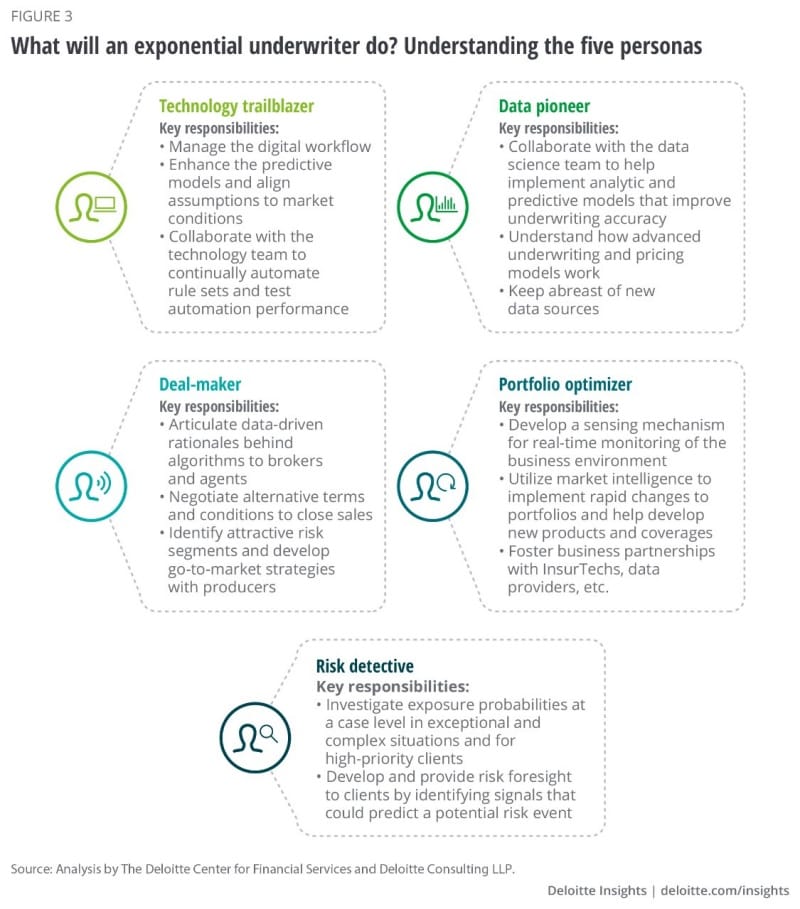

The Future Of Insurance Underwriting Deloitte Insights

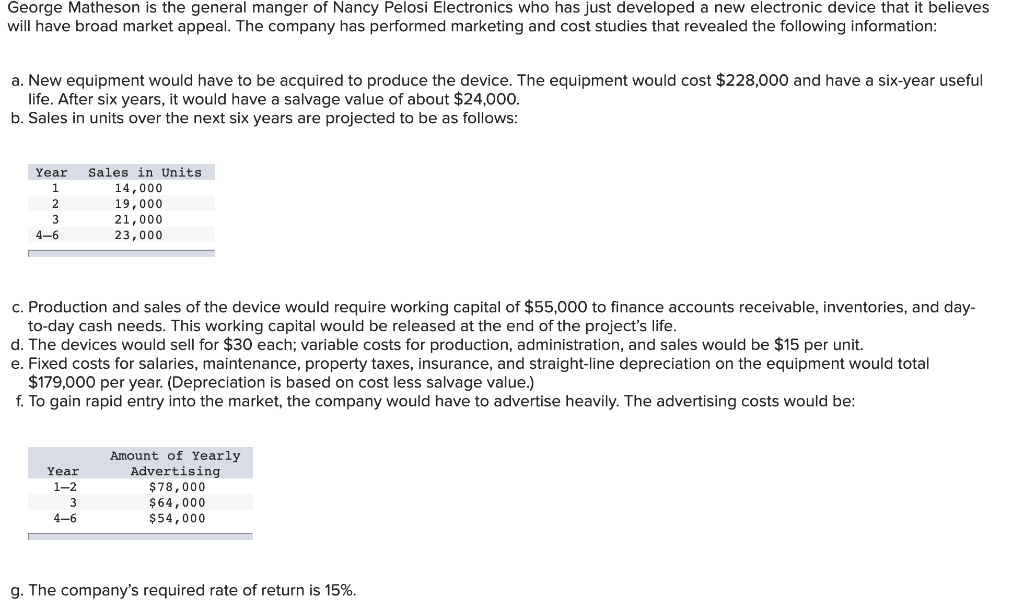

Solved George Matheson Is The General Manger Of Nancy Pelosi Chegg Com

Life Insurance Made Simpler Through Technology Data And Analytics Verisk

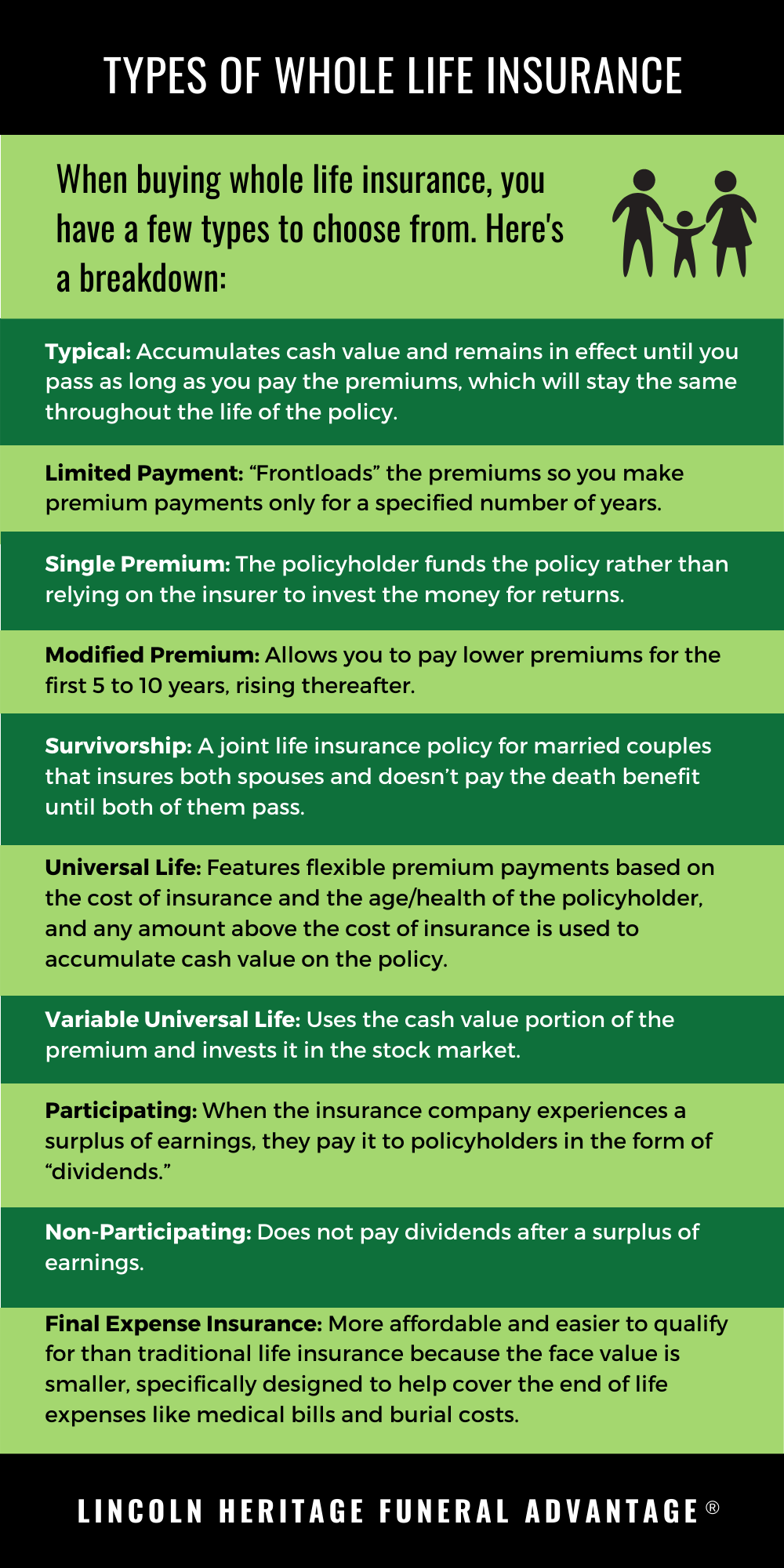

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

/ENTREPRENEUR-FINAL-SR-8c6db24ab16243aa893427aa3bf9d679.jpg)

Entrepreneur What It Means To Be One And How To Get Started

Limited Pay Life Insurance Everything You Need To Know

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition How It Works With Examples

What Is Cash Value In Life Insurance Explanation With Example

10 Best Tips If You Re Buying Life Insurance For The First Time Forbes Advisor

What Are Paid Up Additions Pua In Life Insurance

Whole Life Insurance Quotes October 2022 Policygenius

Life Insurance Compare Policies Free Quotes Policygenius

Don T Fall For That Life Insurance Ad On Tv Kiplinger

What Type Of Life Insurance Policy Generates Immediate Cash Value Insurance Noon